Table of Contents

Introduction

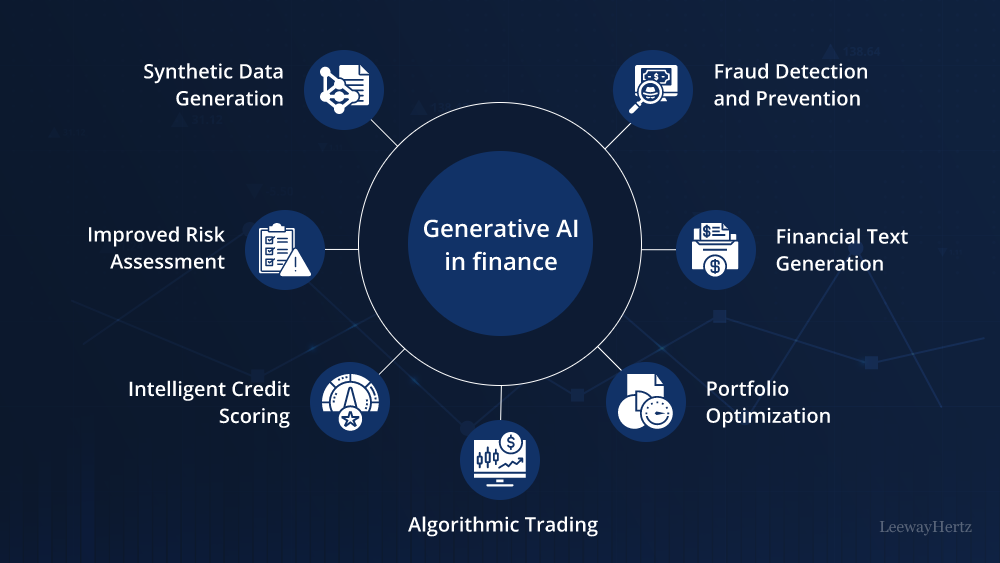

Generative AI is transforming the financial industry, fundamentally reshaping how businesses analyze data, manage risk, engage clients, and optimize operations. By leveraging advanced algorithms capable of creating new content, predictive models, and automation workflows, financial institutions are realizing significant improvements in efficiency, accuracy, and customer experience. In 2025, generative AI is emerging as a cornerstone technology driving innovation across banking, asset management, compliance, and more.

This article explores the current landscape, practical use cases, benefits, challenges, and future trends of generative AI in finance, providing actionable insights for decision-makers and practitioners alike.

What is Generative AI?

Generative AI models, such as GPT and other advanced deep-learning algorithms, create new data and content by learning patterns from massive datasets. Unlike traditional AI systems that perform classification or prediction, generative AI can compose text, images, code, financial reports, and simulations. Its ability to generate contextually relevant outputs makes it uniquely suited for dynamic and complex industries like finance.

Generative AI is rapidly reshaping the finance industry by enabling innovative applications that streamline operations, enhance customer experiences, improve risk management, and accelerate decision-making. This article explores how generative AI is being used in financial services today, its benefits, challenges, and future prospects.

Generative AI refers to advanced machine learning models that can create text, images, data, and even simulations based on the vast amounts of financial data they process. Unlike traditional AI which mostly classifies or predicts, generative AI can produce new, contextually relevant content—making it ideal for complex financial tasks that require synthesis of information.

One of the significant applications of generative AI in finance is automated financial reporting. AI models can analyze raw data from markets, transactions, and operations to draft detailed reports, summaries, and regulatory filings. This saves finance teams tens of thousands of hours annually by automating routine, error-prone manual work.

Risk management is another area transformed by generative AI. These models simulate thousands of market scenarios and transaction patterns to identify risks and fraudulent activities proactively. Synthetic data generated by AI augments traditional datasets, improving the robustness of fraud detection algorithms.

Customer experience improves dramatically with AI-powered virtual assistants. Generative AI allows chatbots to provide personalized, interactive financial advice, answering complex queries and adapting their responses based on user profiles and behaviors. This ensures seamless 24/7 support while reducing customer service costs.

Investment portfolio management also benefits from generative AI. Advisors use AI to simulate diverse economic conditions, helping clients visualize different investment outcomes and optimize asset allocation. This dynamic approach aligns investment strategies with real-time market data and personal risk tolerance.

Compliance functions leverage generative AI for automating document generation and regulatory checking. AI can draft audit-ready summaries and ensure adherence to evolving financial regulations, reducing compliance risks and speeding up reporting cycles.

Despite the advantages, finance faces challenges in adopting generative AI. Data privacy and security are paramount as models handle sensitive financial information. Bias in AI algorithms can perpetuate systemic risks or discrimination if unchecked. Regulatory frameworks are still adapting to AI’s rapid progression, requiring firms to maintain strong governance around AI deployments.

Looking ahead, generative AI will continue advancing personalization in financial services. Real-time adaptive interfaces powered by AI will intervene in financial decisions, providing users with contextual visual and textual cues. Synthetic datasets and AI agents will become standard tools for financial innovation across banking, insurance, and asset management.

Case studies of generative AI’s impact in finance illustrate the technology’s promise:

- JPMorgan Chase’s COiN platform automates contract reviews using natural language AI.

- Goldman Sachs employs generative AI for adaptive market trading simulations.

- Ant Financial deploys conversational AI bots to support over a billion users.

In summary, generative AI is becoming indispensable in finance by automating complex workflows, enhancing decision quality, and personalizing user experiences. With careful deployment focusing on transparency, security, and compliance, generative AI will unlock new value and reshape the future of financial services

Read also: AI Integration in Financial Services: Transforming Wallpaper Personalization and Digital Banking UX

Key Applications of Generative AI in Finance

1. Automated Financial Reporting

Generating accurate and detailed financial reports is time-consuming. Generative AI automates report generation by analyzing raw financial data, creating summaries, and drafting narratives that comply with regulatory tone and style. This reduces human error and accelerates audit cycles.

2. Risk Management and Fraud Detection

Using historical transaction data, generative AI models simulate potential risk scenarios and detect fraud patterns. By generating synthetic data for training, they enhance model robustness, enabling institutions to proactively respond to emerging threats and market changes.

3. Intelligent Customer Assistance

AI-powered chatbots and virtual assistants powered by generative models offer personalized, real-time financial advice and support. These agents understand complex queries, generate detailed responses, and continuously learn from interactions to improve their effectiveness.

4. Portfolio Optimization and Investment Strategies

Generative AI helps financial advisors simulate multiple market conditions, generate diverse investment scenarios, and suggest portfolio adjustments based on predictive analytics. This empowers better decision-making backed by data-driven insights.

5. Compliance and Regulatory Tech

Maintaining regulatory compliance is challenging. Generative AI assists by interpreting new regulations, generating compliance reports, and detecting anomalies in documentation, reducing manual workload and risk of non-compliance.

Benefits of Generative AI in Finance

- Improved Accuracy: Reduces human errors in financial analysis and reporting.

- Cost Efficiency: Automates routine and complex workflows to reduce operational expenses.

- Enhanced Personalization: Delivers tailored financial products and advice at scale.

- Faster Decision-Making: Processes and models vast datasets swiftly, enabling real-time responses.

- Scalability: Supports growing transaction volumes and customer bases with AI-driven automation.

Challenges and Risks

While promising, generative AI adoption in finance comes with challenges:

- Data Privacy and Security: Handling sensitive financial data requires robust safeguards.

- Algorithmic Bias: Ensuring models do not perpetuate discriminatory practices.

- Regulatory Compliance: Aligning AI outputs with evolving financial regulations.

- Integration Complexity: Seamlessly embedding AI into legacy banking systems.

- Talent Shortages: Demand for skilled AI, data science, and finance professionals exceeds supply.

Future Trends in Generative AI for Finance

Hyper-Personalized Banking

Generative AI will power 24/7 personalized banking services, enabling virtual assistants that adapt to individual financial habits, goals, and preferences.

Synthetic Data for Robust Models

Generating synthetic financial data preserves privacy while facilitating better training datasets, making AI models more secure and accurate.

Autonomous Financial Products

Robo-advisors and AI-managed investment funds will become increasingly sophisticated, automatically adjusting strategies based on market changes and client risk appetite.

Conversational AI & Voice Banking

Conversational AI with generative capabilities will handle complex banking conversations using natural language, providing users with intuitive financial guidance.

Implementation Best Practices

- Define Clear Strategy: Align AI projects with business goals and customer needs.

- Invest in AI Infrastructure: Cloud or hybrid deployment based on security and scalability requirements.

- Regulatory Awareness: Build compliance checkpoints into AI systems.

- Focus on Data Quality: High-quality, diverse data is key to successful generative AI outcomes.

- Promote Organizational Readiness: Educate teams, address cultural resistance, and foster AI expertise.

SEO & Content Strategy for Generative AI in Finance

- Use keywords like “Generative AI for Finance,” “AI financial services,” and “finance AI applications 2025.”

- Add well-labeled images, such as alt=”Generative AI for Finance applications.”

- Link to authoritative sources, including finance innovation hubs and AI research centers.

- Structure content with clear headers and short paragraphs for readability.

Real-World Case Studies of Generative AI in Finance

1. JPMorgan Chase: COiN Platform for Contract Review

JPMorgan Chase implemented a generative AI-powered platform called COiN (Contract Intelligence) to automate the review of legal documents and contracts. The AI analyzes thousands of documents quickly, identifying critical data and flagging risks with unprecedented accuracy. This greatly reduces man-hours and enhances compliance.

- Impact: COiN reviews 12,000 documents in seconds, saving 360,000 hours of legal work annually.

- Technology: Generative natural language processing to extract meaningful information.

- Source: JPMorgan Official Announcement

2. Goldman Sachs: AI-Led Trading Algorithms

Goldman Sachs uses generative AI models to simulate and generate possible market scenarios, helping traders make data-driven decisions. These models generate complex scenario forecasts based on historical data and research, creating adaptive trading strategies that improve portfolio performance.

- Impact: Improved prediction of market volatility and enhanced portfolio returns.

- Technology: Generative models combined with reinforcement learning to optimize trades.

- Source: Goldman Sachs AI Insights

3. Ant Financial: Customer Service Virtual Assistants

Ant Financial, the fintech affiliate of Alibaba, has launched advanced AI chatbots powered by generative AI to deliver real-time support and financial advice to millions of users. The AI bots understand complex queries, generate relevant answers, and escalate issues where necessary, dramatically improving customer experience and operational costs.

- Impact: Serves over 1 billion users with instant support, handling massive query volumes.

- Technology: Generative conversational AI with deep learning for natural language understanding.

- Source: Ant Financial AI Research

These case studies exemplify how generative AI is actively transforming the financial services industry by enabling automation, personalization, and predictive insights at scale. Organizations embracing these technologies are realizing improved efficiency, customer engagement, and competitive advantage.

Conclusion

Generative AI is a game-changing force in finance, empowering institutions to innovate, operate efficiently, and deliver superior customer experiences. By embracing this technology thoughtfully and strategically, financial firms can navigate market complexities, mitigate risks, and lead the next wave of digital transformation in 2025 and beyond.